Ten Top Tips On How To Evaluate The Ability Of An Ai Model To Adapt Model Of Stock Trading Predictions To The Changing Market Conditions

The ability of an AI-based stock trading predictor to adjust to market fluctuations is crucial, because the financial markets are always changing and impacted by unpredictable changes in economic cycles, events, and policies that change. Here are 10 suggestions for assessing a model’s ability to adjust to market volatility.

1. Examine Model Retraining Frequency

Why: Regular retraining ensures that the model can adapt to the latest data and changing market conditions.

How to: Check whether the model has mechanisms for regular training with up-to-date data. Models that are trained at regular intervals tend to better incorporate the latest trends and changes in behavior.

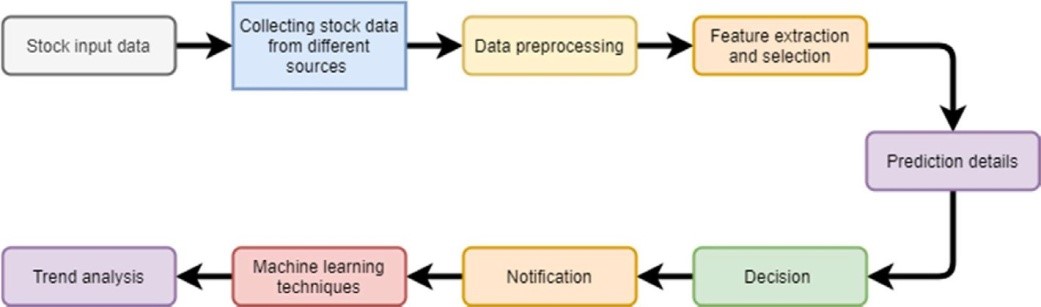

2. Examine the use of adaptive algorithms

Why: Certain algorithms, such as reinforcement learning or online models of learning are able to adapt to changes in patterns more effectively.

What can you do to determine whether the model is based on adaptive algorithms designed for changing environments. Algorithms such as reinforcement learning, Bayesian Networks, or Recurrent Neuronal Networks that have adaptive rate of learning are excellent for coping with market dynamic.

3. Check for the Incorporation Regime For Detection

What’s the reason? Different market conditions (e.g. bull, bear or high volatility) could affect the performance of an asset.

How do you identify the current market conditions and to adjust your strategy, verify if there are any regime detection mechanisms in the model, such as hidden Markov or clustering models.

4. How to Assess the Sensitivity to Economic Indicators

Why? Economic indicators like interest rates, inflation and employment may have a major impact on stock performance.

How: Examine if key macroeconomics indicators are included in the model. This lets it be more aware and react to economic trends that affect the markets.

5. Study how this model is able to deal with volatile markets

Why? Models that do not adapt to volatility may underperform or cause significant losses during periods of extreme volatility.

How to review past performance in volatile times (e.g. major news events, recessions). You can look for options that permit the model be adjusted during turbulent times like dynamic risk adjustment or volatility focusing.

6. Look for Drift detection systems

The reason: Concept drift occurs when the properties of the statistical data pertaining to the market change, affecting models’ predictions.

What to do: Determine whether your model detects drift and retrains itself accordingly. Drift detection algorithms or change-point detection can warn the model of significant changes and allow for prompt adjustments.

7. Explore the versatility of feature engineering

The reason: Market conditions change and rigid feature sets can be outdated, causing a decrease in model accuracy.

How do you find adaptive feature engineering, which allows the features of a model to be adjusted based on market trends. The flexibility of a model can be improved by dynamic feature selection and periodic evaluation.

8. Check the robustness of various models for various asset classes

The reason is that if a model is trained on only one asset class (e.g., equities), it may struggle when applied to others (like commodities or bonds) that behave differently.

How do you test the model across various asset classes or sectors to gauge its versatility. A model that performs well performance across all types of assets will be more adaptable to market changes.

9. Choose Ensemble or Hybrid Models to get Flexibility

What is the reason: Ensembles of models integrate the theories of various algorithms to mitigate weaknesses and allow them to adapt better to the changing environment.

How do you determine the model’s combination strategy. Hybrid models and ensembles are able to change strategies based on the current market conditions. This improves adaptability.

Examine the real-world performance during Major Market Events

What is the reason: A model’s adaptability and resilience against real-world events can be revealed through stress-testing it.

How: Evaluate historical performance in times of major disruptions to markets (e.g. COVID-19 pandemics, financial crises). You can use transparent data to assess how well your model has changed during these events or if there has been a significant degradation in performance.

You can evaluate the resilience and flexibility of an AI prediction of the stock market by using the following list. This will ensure it remains flexible to changes in market conditions. The ability to adapt will decrease risk and improve the accuracy of forecasts under different economic scenarios. Follow the recommended Google stock for site info including stock market ai, ai stock, stock technical analysis, ai on stock market, stocks for ai companies, best ai stocks to buy, open ai stock, stocks and investing, top ai stocks, stock market analysis and more.

Utilize An Ai-Based Stock Market Forecaster To Estimate The Amazon Index Of Stocks.

In order for an AI trading prediction model to be effective it’s essential to have a thorough understanding of Amazon’s business model. It is also essential to understand the dynamics of the market and economic variables that impact its performance. Here are 10 tips to help you assess Amazon’s stock with an AI trading model.

1. Knowing Amazon Business Segments

The reason: Amazon has a wide array of business options, including cloud computing (AWS), advertising, digital stream and e-commerce.

How to: Get familiar with the revenue contributions for each segment. Understanding the drivers of growth within these sectors helps to ensure that the AI models forecast overall stock returns on the basis of specific trends in the sector.

2. Incorporate Industry Trends and Competitor Analyses

The reason is that Amazon’s performance depends on the trend in ecommerce cloud services, cloud technology and as well the competition of businesses like Walmart and Microsoft.

How do you ensure that the AI model is analyzing the trends within your industry such as the growth of online shopping and cloud usage rates and changes in consumer behavior. Include an analysis of the performance of competitors and share price to place Amazon’s stock movements into context.

3. Earnings reports: How to evaluate their impact

Why? Earnings announcements are an important factor in the fluctuation of stock prices, especially when it comes to a company with accelerated growth like Amazon.

How to: Check Amazon’s quarterly earnings calendar to find out the impact of previous earnings surprise announcements that have impacted the stock’s performance. Incorporate company guidance as well as analyst expectations into the estimation process when estimating future revenue.

4. Technical Analysis Indicators

The reason: Technical indicators can aid in identifying trends and reversal points in stock price movements.

How can you include crucial technical indicators, such as moving averages as well as MACD (Moving Average Convergence Differece), into the AI model. These indicators can help you determine the best entry and exit places for trading.

5. Examine macroeconomic variables

What’s the reason? Amazon profits and sales may be affected adversely by economic variables such as inflation, interest rate changes, and consumer expenditure.

How: Make sure the model includes relevant macroeconomic indicators like consumer confidence indexes as well as retail sales. Knowing these factors can improve the ability of the model to predict.

6. Utilize Sentiment Analysis

The reason is that the price of stocks is heavily influenced by the mood of the market. This is particularly true for companies such as Amazon, which have an emphasis on the consumer.

How: You can use sentiment analysis to measure the public’s opinion about Amazon through the analysis of social media, news stories as well as reviews written by customers. Incorporating sentiment metrics into your model will give it an important context.

7. Review changes to policy and regulations.

Amazon’s operations can be affected by a variety of regulations, including data privacy laws and antitrust scrutiny.

How: Monitor policy changes as well as legal challenges connected to e-commerce. Be sure that the model is able to account for these variables to forecast possible impacts on Amazon’s business.

8. Perform Backtesting using Historical Data

Why? Backtesting lets you see how well your AI model would’ve performed with historical data.

How to back-test the predictions of a model make use of historical data on Amazon’s shares. Comparing actual and predicted performance is a good method to determine the validity of the model.

9. Measuring Real-Time Execution Metrics

The reason is that efficient trading is vital for maximising gains. This is particularly true in stocks with high volatility, like Amazon.

How to track performance metrics like fill and slippage. Evaluate how well the AI model is able to predict the best entries and exits for Amazon trades, ensuring execution is in line with predictions.

10. Review Strategies for Risk Management and Position Sizing

Why: Effective risk-management is crucial for capital protection. This is particularly true when stocks are volatile, such as Amazon.

How: Make sure your model contains strategies for risk management as well as the size of your position according to Amazon volatility and the overall risk of your portfolio. This will help limit potential losses and maximize returns.

If you follow these guidelines You can evaluate an AI stock trading predictor’s capability to understand and forecast movements in Amazon’s stock, ensuring that it is accurate and current to changing market conditions. Have a look at the top rated Amazon stock info for site recommendations including best site to analyse stocks, best sites to analyse stocks, ai stocks, best sites to analyse stocks, investing in a stock, artificial intelligence stocks to buy, ai in the stock market, ai investment bot, ai stock predictor, artificial intelligence stock trading and more.